Reform 2023/2025 or the generalisation of e-invoicing in France: the outlines of the DGFIP report

04/12/20

Tax eAlerte

In furtherance of Article 153 of the Finance Law for 2020, the Directorate General of Public Finance (DGFIP) has just submitted its Report on the development of e-invoicing in France to the Parliament on last November 3: “VAT in the digital era in France”.

Reminder of the reform context

With a view to combating VAT fraud and under the impetus of international reforms on periodic and continuous transaction control (CTC models: “Continuous Transaction Controls"), the French government, through Article 153 of the Finance Law for 2020, wishes to generalise e-invoicing between taxable persons from 2023/2025.

The development of e-invoicing in France is the result of a long process initiated by directive of 13 July 20101 (amending the 2006 VAT Directive). This directive sets out the framework for B2B e-invoicing in EU countries, with the "preamble" that the use of this method of invoicing be subject to acceptance by the recipient.

As part of the B2G relations, a generalisation of e-invoicing has already been carried out in France and more generally in Europe under the auspices of Directive 2014/61/EU.

With regard to the generalisation of B2B e-invoicing in France, a new step has just been taken with the submission of a report to Parliament by DGFiP to provide clarification on the scheme.

This generalisation is intended to benefit both companies and the authorities as it would in any case:

- Strengthen the competitiveness of companies by reducing the administrative burden related to invoice management and securing commercial relations: reducing the administrative costs associated with the invoicing process and limiting disputes related to payment terms,

- Strengthen the prevention and fight against VAT fraud through automated cross-checks,

- To promote the knowledge of all activities of companies on an ad hoc basis in order to encourage a more effective management of government actions in the area of economic and tax control and policy,

- Facilitate VAT declarations on medium to long term by pre-filling the data.

The choice of electronic invoicing (e-invoicing) supplemented by a transmission of invoicing data (or "e-reporting"): a trusted "mixed" and "win-win" model

In order to meet these objectives, the report structured in two parts (general presentation and technical analysis), first recommends the mandatory electronic transmission of sales invoices between the supplier and its customer through a platform (or several platforms), which may belong to the state or private (possibly certified by the State).

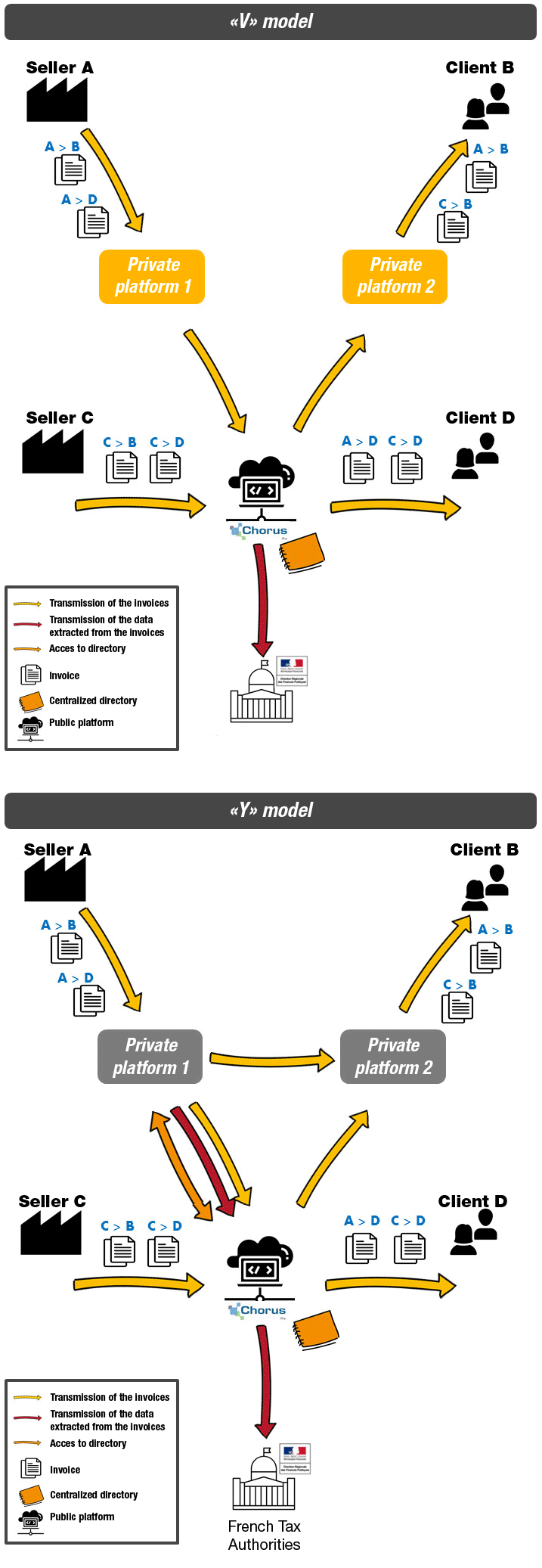

Two technical diagrams/solutions are presented:

- "V” model: mandatory transit of invoices through a public platform that ensures the transmission of invoices to the customer via a private platform, in the form of a single hub. The public platform would extract from the invoices the relevant data for the authorities and forward it to the information system (IS) of DGFIP.

- “Y" model: invoices can transit directly between certified private platforms without using the public platform. Certified private platforms would extract the information for the authorities from invoices and forward it to the public platform, which would group it and send it to the IS of DGFIP. The primary advantage is that these operators can ensure the transmission while managing the multiple billing formats.

(1) Directive 2010/45/EU of the Council of 13 July 2010 on the common system of value added tax as regards the rules on invoicing: second Invoicing Directive.

At this stage, the report highlights the numerous constraints inherent in the "V" model (risk of non-constitutionality with the introduction of a state monopoly for the exchange of billing data, transmission of invoices interrupted in the event of system failure, etc.).

The report clearly favours the "Y" model, more resilient and favoured by the stakeholders, which offers more flexibility, particularly for companies that have already been able to establish electronic invoicing flows (particularly EDI) via private platforms, in that it limits the costs of adaptation and entry into this reform, while also allowing other taxable persons to transmit invoices directly to the public platform.

Furthermore, the report also points out that the e-invoicing obligation cannot be extended to all transactions carried out by a taxable person, particularly due to the lack of harmonisation of the rules applicable to e-invoicing at European and global level, as well as the absence of any obligation, except for exceptions, to issue invoices in relation to B2C relations.

Thus, in order to effectively combat VAT fraud, this obligation must also be accompanied by an obligation to transmit data ("e-Reporting") in order to be able to cover a wider set of flows and obtain more information essential for the identification of the VAT treatment applied (payment of invoices, etc.).

Details of the scope of the operations concerned by the e-invoicing obligation and the nature of the information sent to the authorities

Scope of application of the obligation of the mandatory e-invoicing :

The obligation to issue electronic invoices would be limited to domestic transactions between persons subject to VAT (in accordance with article 256 A of the French General Tax Code) falling within the general and territorial scope of the invoicing rules

Furthermore, foreign taxable persons not established in France would not be subject to the provisions of article 153.

Adjustments and clarifications will also be expected for specific business sectors currently provided for by the doctrine such as banking and finance sector, construction works and micro-entrepreneurs.

Content of invoice

With regard to the content of invoices, all the tax references stipulated in article 242 ninth A of Appendix II to the French Tax Code (“Code Général des Impôts) must appear on the invoices as well as the mandatory commercial information currently provided for by the French Commercial Code.

However, for the purposes of the fight against fraud, other data must be indicated in the invoice, in particular the buyer's identifier (corresponding to SIREN number). Thus, a change in the legislative framework will have to be made by the legislator.

With regard to other additional information, such as "business information" (mode of delivery, or incoterm, VAT codes, partner functions, etc.), the latter should not be made mandatory, even if often considered relevant to the determination of VAT rules on transactions.

Scope of the e-reporting obligation

First of all, if the report mentions that taxable persons not established in France would not be subject to the provisions of Article 153, the latter does not explicitly mention taxable persons who are or would not be affected by this additional e-reporting solution.

As part of this related obligation, the report identifies three categories of additional data:

- Data related to the status of invoices and their payment: this information on the life cycle of the invoice (invoices remaining to be paid, invoices paid, received, expected payment, invoices rejected by the recipient, etc.) will allow for the allocation of "certain dates" to invoices, thereby strengthening the management/progress of the processing of invoices and cash flow and the control of the rules related to the chargeable event and the liability for VAT, particularly for the services (collection except option for debits).

- B2C transaction data: for companies carrying out only or partly B2C transactions, the authorities would have only a limited vision or a lack of vision of the business of these companies (no obligation to issue an invoice to a particular customer from a VAT point of view).

However, this information is essential to determine the taxable amount for VAT when carrying out first level controls, checking the correct application of VAT rates or whether a particular customer carries out undeclared occult business activities. The data collected shall concern, by transaction, their date, amount excluding tax, the VAT rate and the amount of VAT due, but shall not mention the consumer's registered indication.

- Data on non-domestic sales (intra-Community or export): this non-domestic data will help detect unjustified carousel fraud or unjustified intra-Community exports/deliveries (for B2C, it will be mainly necessary to verify the proper application of the rules for distance sales in particular in the light of the e-commerce reform applicable as from 1 July 2021).

As regards the latter point, it would be important to note that on some occasions the report also addresses the obligation to report information related to certain flows of purchases, including imports. The scope of this obligation must therefore be specified by the Government.

The choice of Chorus Pro as a free public platform and hub of billing data for DGFIP information system

With the objective of preserving the use of current invoice exchange solutions, the Chorus Pro platform (already tested by the French Agency for State Financial Information Technology (AIFE) from January to June 2020) will be used as the relevant tool through which all data of exchanges between companies will be transmitted to the IS of DGFiP. However, the use of Chorus Pro platform will require some adjustments (usability, communication, reporting and management functions of companies and their users, interfacing arrangements, ability to collect significant volumes in B2B, etc.).

Reform implemented gradually

As it has been done for the deployment of the Chorus Pro platform for B2G invoices, and to take into account the impact that such reform should have on companies, the implementation of the electronic invoicing obligation will be extended over time:

- From 2023, an obligation to receive the electronic invoice for all companies (BIG BANG effect),

- An obligation of progressive issuance, depending on the size of the companies:

- 2023 for large companies,

- 2024 for intermediate-size enterprises,

- 2025 for SMEs and micro-enterprises.

Clarifications on the legal and technical work to be carried out

First of all, DGFIP first recalls that the European Commission, as part of its action plan adopted on 15 July 2020, began work on the transmission of transaction data as well as the development of e-invoicing as part of the B2B exchanges.

It states, however, that this work should not be completed in the short term (not before 2026/2027) and that the generalisation of mandatory e-invoicing in France is carried out with a view to an easy adaptation to the European system that could be adopted.

It is also specified that the reform of Article 153 should not result in major changes in the current tax regulations, particularly with regard to the following points:

- Article 289 V of the French Tax Code (obligation to ensure the security of invoices)

- Article 289 VI 2° of the French Tax Code (original character allocated to the electronic invoice)

- Article 289 VII of the French Tax Code (methods of making e-invoices secure - in the absence of an obligation to use tax EDI)

- Article L. 102 B of the Book of Tax Procedures (duration of retention of documents, in particular invoices), the authority's control capacity to be preserved

- Article A. 102 B-2 of the Book of Tax Procedures (conditions of scanning paper invoices), retained for transactions outside the scope of the e-invoicing obligation

- Articles relating to solutions controls (tax EDI/Signature/Reliable audit trail): Article L 13 D / F of the Book of Tax Procedures or L 80 FA with regard to articles relating to the authorities’ power to control the methods of securing invoices

- Articles relating to the right of inquiry (L. 80 F, G and H of the Book of Tax Procedures): not amended to the extent that it is intended to retain, at first, a plurality of formats.

The anticipated legislative amendments would focus on:

- Article 289 VI 1° of the General Tax Code (definition of the electronic invoice and acceptance to receive): to be completed in order to provide for the cases of compulsory recourse to the electronic invoice, the format imposed where applicable for this type of invoices and the removal of the condition of acceptance by the recipient for their transmission and availability

- Article 242 ninth A of Appendix II to the General Tax Code: add or creating a new article to define the mandatory information and associated data, in particular the SIREN number of the parties (common identifier.

- Article L. 102 C and R*. 102 C-1 of the Book of Tax Procedures (modalities and place of storage of invoices)

- Article 271 II of the General Tax Code (Article 178 a) of the Directive): to be amended to make the right to recovery of VAT subject on the submission of a dematerialised invoice (issued in the name of the deductor) on a platform within the framework of business-to-business commerce

This essential point will strengthen the effectiveness of the system to combat VAT fraud, even if the flexibility of the current ECJ case law must be assessed when the taxable person establishes that the material conditions (i.e. funds) of this right are met (ECJ 5-12-1996 case 85/95, John Reisdorf, ECJ 21-11-2018 case 664/16, Lucreţiu Hadrian Vădan)

- Creation of a new ad hoc obligation for information which does not fall within the scope of article 153: e-reporting obligation (electronic data transmission) with regard to data relating to international transactions, B2C transactions and payment data.

With regard to the obligation to of the Reliable Audit trail within the meaning of article 289 VII 1° of the General Tax Code, DGFIP specifies that the implementation of the electronic invoicing obligation cannot automatically exempt taxable persons from this obligation and remains relevant. The Reliable Audit trail is therefore maintained and will always be an important asset for companies in their relationship with the tax authorities in the event of an audit.

In addition, DGFIP recalls the obligation to obtain derogations from certain guiding principles currently laid down by the VAT Directive (through Article 395) and also details the various regulatory work to be carried out with a view to ensuring compliance with French tax legislation. The implementation of Project 2023 must be carried out in accordance with the rules of the common VAT system defined by the VAT Directive (necessity and proportionality of the requested derogations and reasons for the lack of alternative solutions under current law).

Finally, the report highlights the obligations of the various parties (public platforms, private platforms, etc.) with regard to sensitive and personal data, in particular with regard to compliance with the GDPR.

Many major uncertainties remain and need to be clarified

The DGFIP report is a major step forward in implementing a mandatory e-invoicing solution for French companies.

However, many issues remain to be addressed and will need to be clarified in the coming months with all stakeholders, in particular:

- Certification: Terms and conditions of certification of private platforms (in the preferred Y model).

- Clearance model: As part of the adoption of an "e-Invoicing Clearance" model, it is necessary to specify the terms and conditions for validating the invoices as well as the procedures for sending confirmation of the validation of the invoice. Surprisingly, no relevant comments are made on this intrinsic feature of the clearance models.

- Data control: Details as to the precise nature of the controls (formal/qualitative, first level) to be carried out by platforms (private or public) as well as the associated rejection conditions and guarantees offered to taxable persons.

- Details on invoice and data: Adopted accurate list of billing data required for both e-invoicing and reporting obligation (tax, commercial, additional data).

- Proposed formats: In a desire to remain open to the various billing formats, the report does not seem to clearly decide which billing formats will be allowed (XML, CSV, JSON, YAML, EDIFACT, mixed formats such as Factur-X, UBL 2.1 already in line with the European format EN16931, etc.). However, it is intended to maintain, at least temporary, the possibility of using non-structured PDF image formats (the platform will then generate a mixed format consisting of structured data and a readable PDF on screen).

- Tax EDI and Electronic Signature: If the report states that the provisions on securing invoices (Article 289 VII of the General Tax Code) should not be amended (including the maintenance of the Reliable Audit Trail), clarifications will be expected on the implementation (and related consequences) by taxable persons and/or private platforms of tax EDI or qualified electronic signature schemes (or equivalent devices - RGS 2** and 3*** or compliant the European eIDAS Regulation). Would the electronic signature, which has been harmonised in Europe since 1 July 2016 (eIDAS) and completely omitted from the report, be at risk?

- Transmission modes: clarification should be made of the authorised modes e-invoicing and additional data (e-reporting) - "Machine to Machine" mode in structured/EDI format (in line with the primary objectives of Article 153), combined with "appropriate" solutions for VSEs/SMEs, such as sending in PDF text format or web entry on the public platform. These three alternatives currently exist for B2G flows via Chorus Pro. The use of transmission methods may differ depending on whether or not the seller has a (certified) private platform.

- E-reporting: With regard to the e-Reporting system, the terms of application still need to be defined, particularly the data to be transmitted or the data transmission format.

- Consideration of purchases: The report also addresses on several occasions the obligation to report information related to certain purchases, including imports or intra-Community purchases. The scope of this obligation must therefore be specified by the Government.

- Foreign companies: If the report mentions that taxable persons not established in France would not be subject to the provisions of Article 153, the latter does not explicitly mention taxable persons who are or would not be affected by this additional e-Reporting solution.

- Frequency of data transmission obligations (e-invoicing and e-reporting): Pure Real-time/Near Real-time? Periodic (monthly/bimonthly)? Clear and practical confirmations must be provided.

- Pre-filling CA3: Regarding the objective of article 153 of the pre-filling in the medium or long term of VAT returns (CA3) based on invoicing and reporting data: no additional information is provided (which lines, sales/purchases, consequences in terms of control/verification for taxable persons, etc.).

- Other important elements to consider: Management and updating of the directory of companies managed by the public platform, archiving arrangements unique or not for the parties and impact on current regulations (benefits/drawbacks), the future of PDF invoices, practical terms of post-reform tax control (impact on the Accounting Entry File (FEC) and obligations relating to the tax control of electronic accounting data (CFCI): Article L 47 A I and II of the Book of Tax Procedures), practical management and asset control/end-of-year discounts v. Initial invoices), etc.

In the coming months, all these issued will be the subject of workshops with all stakeholders in order to achieve a mixed model with the widest possible consensus.

Finally, this report highlights the recognition of future developments at Community level since the European Commission has initiated work on the transmission of transaction data by companies (with the development of e-invoicing) as part of its action plan adopted on 15 July 2020 for fair and simplified taxation.

***

It is highlighted that, following the report, an amendment (II-3211) to Finance Bill 2021 of 6 November was also published and adopted on 13 November, at the end of which the government proposes to act by order no later than September 2021 in order to:

- Generalise the use of e-invoicing and modify the terms and conditions of the e-invoicing model

- Create an additional obligation of digital transmission to the authorities of information relating to transactions carried out by persons subject to VAT who do not result from electronic invoices, either that they are complementary to those resulting from it (e.g. data related to payment of invoices), or they relate to transactions which are not electronically invoiced or are not subject to the invoicing obligation for the purposes of value added tax (e.g. B2C flow or non-domestic flows): e-reporting obligation.

In addition, the DGFiP presented on November 24, 2020 to external stakeholders its report on the e-invoicing mandate and the VAT e-reporting obligation from 2023.

A “Project Management” will be set up in early 2021 within the DGFiP, which will be responsible of the next steps. In collaboration with the AIFE (French agency for the state financial Information System), consultations organized in “Workshops” with stakeholders will be carried out at the end of 2020 / during 2021 around various themes (notion of invoice, e-reporting, control, IT format and uniqueness, archiving and directory , etc.).

Actualités juridiques et fiscales

Contactez-nous